Home Price Stability and Energy Efficiency

Almost all Americans have been affected by the housing crisis of the last decade. Home prices rose sharply several years ago, and then quickly fell soon after that as the market couldn’t sustain the growth, and lending options were made available to those who were unable to make their payments. Many homeowners purchased homes they were unable to afford, and many simply lost their jobs when the economy went south and were unable to make their mortgage payments. As the threat of foreclosure loomed closely, some Americans looked for any way they could to save money on their monthly bills in order to stay in their current homes. Many turned to “green” options in order to make their homes more energy efficient. A recent study found that those borrowers who implemented changes to make their homes more energy efficient are one third less likely to default on their mortgage payments and lose their homes. With this information, it would be safe to presume that energy efficiency also leads to more money in your pocket for the important things.

The Study

A group of researchers from the University of North Carolina recently completed a study where they looked at mortgage loans on 71,000 properties across the country. Each of these loans was taken out between 2002 and 2012. Of the homes that had received an Energy Star certification, borrowers were 32% less likely to default on payments when compared to homes that lacked improvements for energy efficiency. The study also found that those homes with Energy Star ratings had utility bills that were lower than homes without by about fifteen percent.

The study also took into account the neighborhood the home was located in, the type of loan the homeowner took out, and the characteristics of the household.

What Is Energy Star?

As a way to decrease the dependence of consumers on foreign substances and to preserve and protect the environment, the federal government set up the Energy Star program for homeowners and energy related products. The program is controlled by the Environmental Protection Agency (EPA) in order to help individuals and businesses save money and keep the climate safe with better efficiency for energy.

Energy Star is a comprehensive approach to the entire house to improve the efficiency. Common home improvements that are implemented by homeowners who are looking for this seal are:

- Ductwork sealing

- Window replacement

- Adding insulation

- Sealing leaks

- Improvement of heating and cooling systems

- Upgrade appliances, lighting, and water heaters

- Using renewable energy systems

Benefits Of Energy Efficiency

Many of the improvements that are encouraged by the Energy Star certification program also help to make the home more comfortable and safer for homeowners. Some of the benefits homeowners can reap from improving the efficiency of their homes are:

- Lower utility bills

- More comfortable rooms in the home

- High quality work performed by trained contractors

- Protect environment by reducing greenhouse gas emissions

- Third party quality control check

Contractors who perform upgrades to your home can receive a special certification from Energy Star that helps them to better understand the efficiency of a home and how to lower the total energy consumption. When a homeowner decides to improve the home, using a contractor with an Energy Star approval ensures that they are getting the best deal and the best work for lowering the energy consumption of the home.

What It All Means

Researchers believe that the findings of the study should be a big factor in how loans are evaluated and when the underwriting process of a mortgage begins. With such a significant number, it is believed that this is solid information that will make a difference in how home loans are figured and approved.

There are several significant implications that can be made by the study. The first is that lenders may be more flexible when borrowing money to homeowners who improve the energy efficiency of the home. With a thirty percent lower chance of default, a homeowner who borrows from a lender is a much lower risk than someone who is not concerned with energy efficiency.

Borrowers may also be allowed a lower credit profile if they are interested in making homes more energy efficient. Because they are less likely to default, the former payment history of the person may not have as much of an impact in these situations as previously believed.

When debt to income ration is factored into a borrowing equation, those with energy efficient homes may be able to have a higher ratio than traditional borrowers. Those who refinance homes that are energy efficient may find themselves with more loan options even if they have more debt and a lower credit profile.

The Benefits

Upgrading the energy efficiency of a home has many benefits. Some consumers make improvements simply because they are concerned about the environment and the home’s reliance on substances like oil and gas. These materials are imported from countries that are typically hostile toward the United States, and have become more expensive even as Americans lose jobs and run out of money. Many consumers change how their homes use energy simply to ensure that they are not forced to rely on these substances for comfort and security.

Other consumers are concerned with the money savings that come with improving the energy efficiency of the home. With certain updates, utility bills may drop close to twenty percent for the average homeowner. For Americans who are looking to save a penny in any way they can, this can be a large amount of money every month.

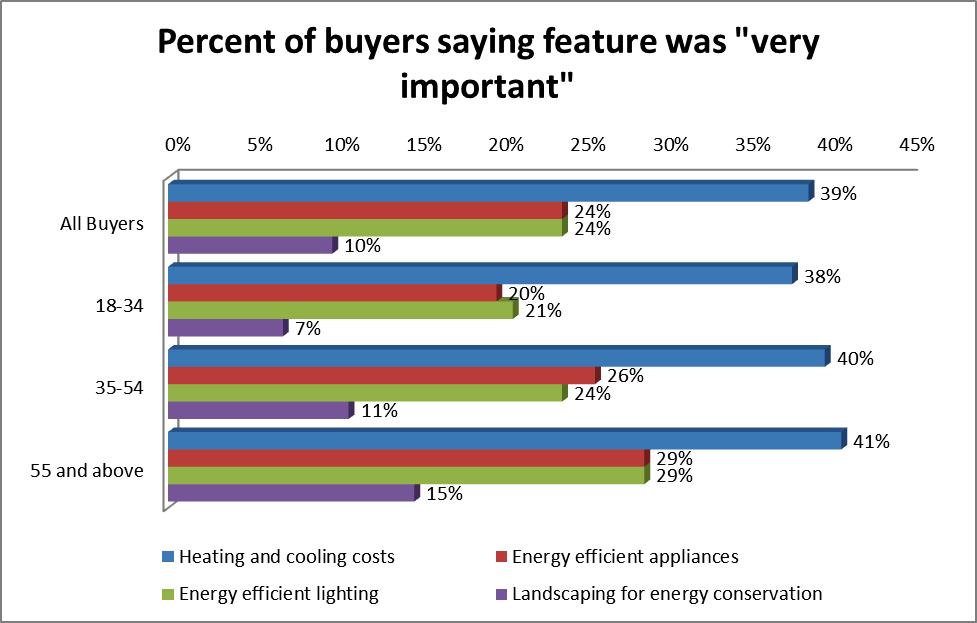

Updating the energy efficiency of the home can also increase the resale value when the time comes to sell. Buyers are more interested in homes that are more efficient and use the latest technology for energy control.

As stated above, another benefit to creating a more energy efficient home is the flexibility that may be allowed in the near future for those who appear to be less likely to default on their mortgage payments.

A Win-Win-Win Situation

Consumers who make their homes more energy efficient take part in a situation that has everyone winning. The environment is better protected from destruction and preserved for future generations, lenders are more confident in the borrower’s ability to repay the loan, and the homeowner saves money. According to this recent study, there is no reason every homeowner should not be searching for ways to improve their home’s energy efficiency.